Part 1: The Threat to SaaS – Why CFOs Should Be Worried

The more we look into the future of work, the more often we encounter industries and business models ripe for disruption. It looks like the golden era of SaaS are coming to an end.

I was sat at a Board meeting with 3 investors and my co-founder, Billie, trying to figure out how to pivot our consumer bank business model to something more investable.

“If only this was a SaaS business, your revenues scale and each new customer is basically free”.

Back then, a vertical Software-as-a-Service (SaaS) business was almost a ticket to success - today, SaaS founders, CFOs and Boards are worried. That means you should be too.

For over a decade, SaaS has been a reliable engine of growth, defined by recurring subscriptions and (mostly) per-seat licenses. But the rise of autonomous AI “agents” threatens to upend these fundamentals. Even Microsoft CEO Satya Nadella has warned that the “notion that business applications exist” could “collapse” in the new era of AI agents . In other words, the traditional SaaS model that CFOs bank on may be heading for a drastic overhaul.

The Economic Foundations of SaaS – and the Cracks Appearing

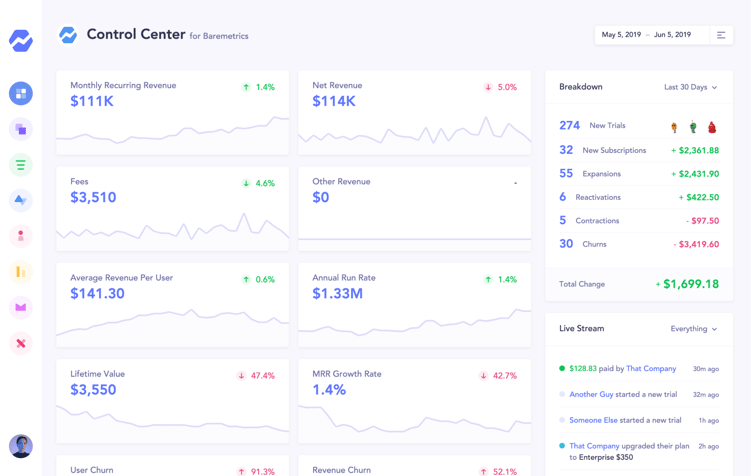

SaaS became king by selling software as a subscription – predictable revenue, high margins, and growth by adding more users (or seats). Investors loved metrics like annual recurring revenue and net dollar retention as companies locked in customers for the long haul. It’s not hard to understand why.

For 15+ years, this model thrived. All good things come to an end. Revenue growth for public SaaS firms has slowed, and valuations (as a multiple of revenue) have fallen back to 2016 levels.

Why? There’s a few reasons.

Software budgets are getting tighter. Many businesses are scrutinizing their tech spend and consolidating tools.

Hiring has slowed. Without new employees, businesses don’t need more SaaS licenses. Fewer seats = lower revenue growth.

SaaS is easier to build than ever. Why pay for something when you can build it yourself using no-code tools and AI?

Subscription fatigue. Enterprises don’t want to pay for a dozen SaaS tools anymore—they want solutions that actually deliver outcomes.

After years of expanding tech costs, the easy expansion revenue of the past is no longer a sure thing.

Now enter the AI agents – a technology leap that strikes at the heart of how SaaS businesses earn money. Unlike standard software or even advanced chatbots, **AI agents don’t just assist users; they act on behalf of users, autonomously making decisions and carrying out tasks .

A Deloitte analysis puts it bluntly: while chatbots can chat, agents can reason and take action. This isn’t theoretical future-speak; it’s already happening.

For example, Microsoft’s 365 Copilot can draft emails or summarize documents, but an AI agent goes further – it could serve as a virtual project manager or even reconcile financial statements to close the books without human intervention. SAP, a major enterprise software firm, describes AI agents that can “choose a course of action, design a plan, gather relevant data, and employ multiple software tools” to complete a multi-step process .

In plain terms, the AI isn’t just using one app – it’s using whatever apps or tools it needs to get a job done, all on its own.

This has immediate, real-world implications. Over half of organizations are already exploring AI agents, and 37% are piloting them. Software company CFOs have taken note of the fact that clients are eager for efficiency and cost savings and these agents promise both, without complaints, holidays or performance reviews.

Think about it, an AI worker that can log into software and perform tasks 24/7 – without a salary – is the ultimate productivity boost. But here’s the flipside: if one AI agent can do the work of five people using your software, how many user licenses will that customer renew next year?

The Key Assumptions that Drive SaaS

The three key assumptions underpinning SaaS business models are: (1) revenue scales predictably with user growth, as more seats or accounts drive expansion; (2) software delivery costs remain low and fixed, enabling high gross margins and near-infinite scalability; and (3) recurring subscriptions create stable, long-term revenue streams, ensuring high customer retention and predictable cash flow.

I.e.: More employees or more active users meant more revenue. AI agents shatter that link.

If a single AI agent can handle tasks for an entire team, the old “per-seat” pricing logic breaks down.

The success of AI-powered software will directly contribute to the erosion of the need for seats that SaaS providers historically relied on. In other words, your biggest customers might not need more logins or subscriptions as they grow – they might need fewer, because an AI is doing the heavy lifting.

Consider a scenario: A mid-size company uses a popular SaaS CRM and pays for 50 sales reps on the platform. Now they deploy an AI sales assistant that automates outreach, data entry, and even initial customer responses. That assistant might use one account to do the work of those 50 reps. Suddenly, the CFO of that client company is thinking, “Why am I paying for 50 human users when my AI handles much of the work?” The next renewal, they negotiate down to maybe 30 human seats plus one AI integration license. Revenue drops. Multiply this across hundreds of customers, and you see the growth engine of seat-based SaaS stall out.

Goodbye cheap growth

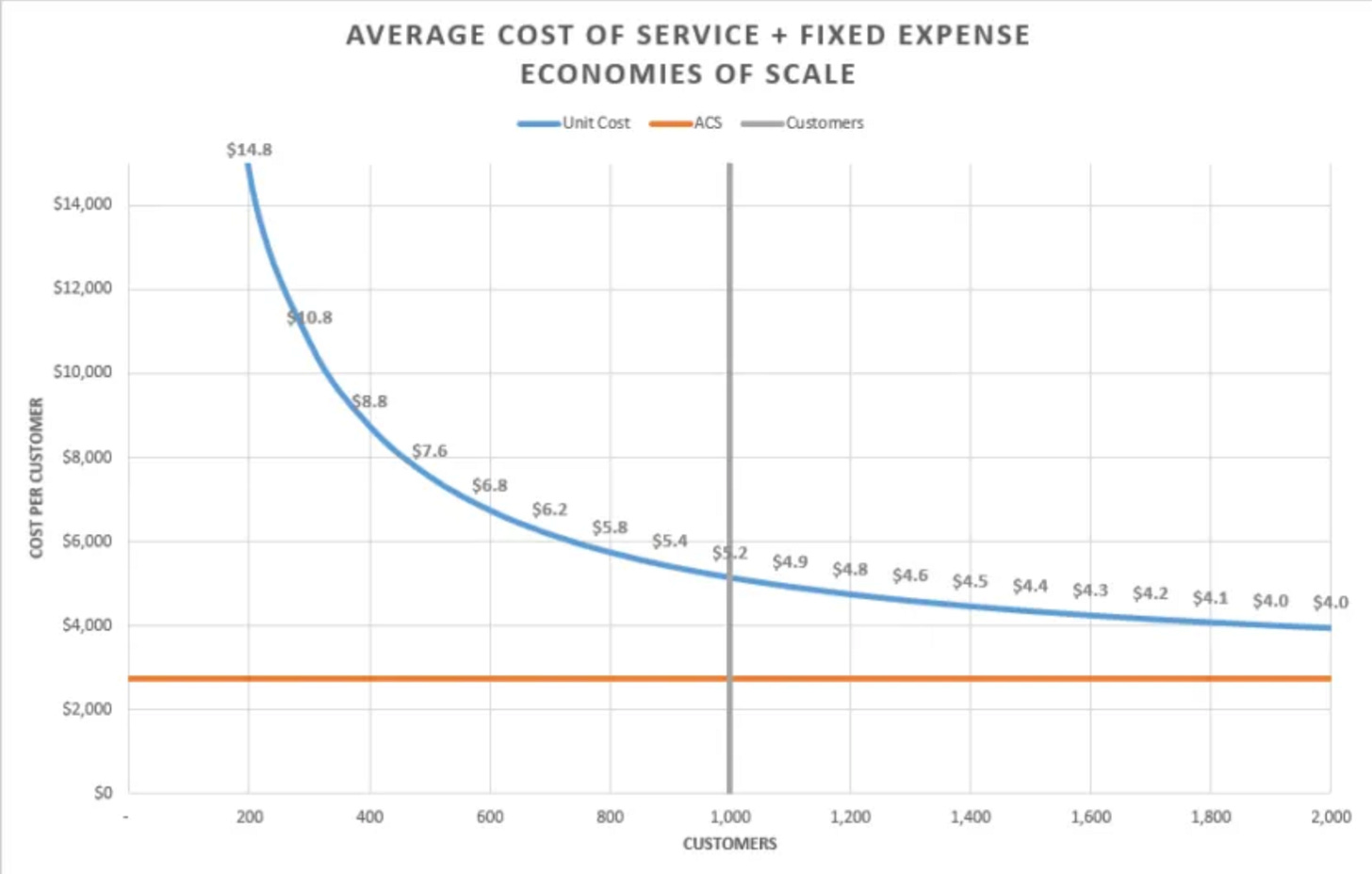

Traditional SaaS businesses benefit from low marginal costs. In theory, once the software is built and hosted, serving an additional user is nearly free, leading to high gross margins (70-80%). This is because costs like cloud hosting, customer support, and engineering remain relatively fixed while revenue scales with new users. AI agents, however, invert this dynamic.

AI-driven agents incur variable costs with every task they perform, due to cloud compute expenses, API calls, and data processing requirements. For example, an AI agent performing complex document analysis or customer support tasks generates incremental compute costs each time it runs, making its cost structure more akin to cloud infrastructure or service businesses than traditional SaaS.

This means that SaaS businesses that raised significant venture capital under the assumption of unlimited, low-cost scaling will no longer benefit from this advantage—growth will come with rising costs, requiring a fundamental rethink of pricing, margins, and investor expectations.

Output vs outcome based pricing

It’s not just seats. AI agents fundamentally change how software is valued. This is perhaps long overdue and closes the gap between paying for outputs vs delivering outcomes.

SaaS economics today are built on continual usage: we assume customers log in regularly, find the tool indispensable, and expand usage over time. But an AI agent doesn’t need a pretty interface or daily active usage in the human sense – it just needs an API and a goal.

Software that can prove it delivers outcomes (e.g. “improves month-end close speed by 50%” or “increases lead conversion by 20%”) will win, while software that only offers a toolbox with no clear outcome might get squeezed out by AI that uses that toolbox more efficiently.

For C-Suite leaders and CFOs in particular, this should feel like an earthquake. The predictable subscription revenues and linear user growth models could give way to more volatile usage-based incomes tied to how much work AIs perform. If SaaS customers start demanding to pay only for what the AI actually accomplishes, many companies’ pricing models will need a complete rewrite.

Why Every Executive Should Care

This isn’t just a problem for SaaS CFOs—it’s a shift that every business leader should pay attention to. Even if you’re not running a SaaS company, this shift is coming for you.

Right now, your organization probably relies on dozens of SaaS tools—for CRM, marketing automation, HR, finance, IT management, and more. But if AI agents are about to reshape how software is used and paid for, that means your entire tech stack could change—and with it, your software contracts, vendor relationships, and risk profile.

Think about it like this: If HubSpot’s AI assistant becomes your go-to for marketing automation, why stop there? It might start pulling in CRM data, sending emails, even handling customer support across other tools. Suddenly, HubSpot isn’t just your marketing system—it’s your agentic layer for multiple business functions.

Now imagine a different scenario—what if Microsoft Copilot becomes your primary AI agent? Then maybe your marketing automation happens inside Office 365, not inside HubSpot. Who wins this battle dictates whose software remains indispensable—and whose fades into the background.

Stop before you (auto)renew

Here’s why you should start thinking about this now. Poor tool selection could mean paying for redundant tools, getting locked into outdated contracts and missing out on AI-driven efficiencies.

Before you renew that next SaaS subscription or sign a long-term contract, ask your provider these critical questions:

1. Who owns the AI agent in your ecosystem?

Is the SaaS vendor integrating AI natively, or will an external AI assistant eventually do its job better?

If AI tools like Microsoft Copilot or ChatGPT start handling workflows across multiple apps, does this SaaS tool still add value on its own?

2. How does this tool justify its pricing in an AI world?

Does it charge per user—even if AI is reducing human interaction?

Can it prove its value in outcomes, or is it just another tool in the stack waiting to be replaced?

3. What happens if I stop using their interface?

If an AI agent can interact with multiple systems and pull data from everywhere, do you really need to log into this SaaS tool anymore?

Some platforms may lose relevance if they become just another backend system that an AI agent calls via API.

4. Will this vendor be the one consolidating tools—or will they be the one getting consolidated?

Right now, software companies are in an AI land grab—whoever owns the primary AI assistant in your workflow could eventually absorb the functions of adjacent SaaS tools.

If HubSpot’s AI assistant beats out another sales or marketing automation tool, why keep paying for both?

The Takeaway - Customers Stand to Win.

As AI agents become the primary interface for work, some SaaS tools will lose their relevance, while others will become the dominant AI orchestrators of your workflows.

More SaaS companies will compete for the same processes - those adjacent to their core. This could provide more choice and optionality, but equally a confusing and overlapping technology estate. Played correctly, however, shifting toward outcome-based pricing allows stronger alignment of incentives and costs.

Executives need to rethink their software stack today—or risk paying for tools that AI is about to replace.

In Part 2, we’ll cover how SaaS companies should respond—and how businesses can protect themselves by choosing the right AI-driven software partners.

(Stay tuned for Part 2, where we dive into how SaaS companies can adapt and turn this agent-driven upheaval to their advantage.)